Ultimate Guide to PayPal That Every Freelancer in Kenya Will Ever Need

Precisely what is PayPal?

In the simplest of terms, PayPal is an online service that enables you to pay, send money and accept payments. A user must link their debit card or credit card to their PayPal account.

Depending on the e-commerce site you are using you can pay by choosing PayPal at checkout, by simply logging into your PayPal account, and confirming your payment. And PayPal completes the process for you in an instant.

Besides shopping, PayPal is the go-to platform for freelancers in Kenya, mainly because their clients prefer to pay them through it. Having used it for the past six years to pay for my web hosting and domain subscriptions, and receive payment from my Swahili translations clients I can say it is pretty fast and secure.

A PayPal member is able to:

> Easily transfer money from your bank account to your PayPal account (charges will apply)

>Transfer money from your own PayPal account to another member’s PayPal account (an email verification is sufficient).

>Transfer money from your PayPal account to your bank account (equity bank has partnered with PayPal to facilitate this)

>Have a report or statement mailed to you for the balance of your PayPal account without any charge.

>Create invoices and estimates for free!, this is one of the coolest feature provided by PayPal. Imagine the amount of money and time you will save by using this free of charge feature.

>Get a PayPal debit card that you can use to make real-world purchases from your PayPal account (right from your computer)

Are Paypal Fees Fair?

Well is anything in this world fair? That will highly depend on your situation and stand. I, for one, tend to believe that PayPal fees are not fair-minded mainly because charges vary from continent to continent and some countries have lower costs, and some terms are more friendly as compared to African countries.

I do understand they are a business, and they have to make money, but i do hate paying their fees. For every amount, you receive, there is a fixed charge of 4.4% +$0.30 per transaction!.

PayPal also has a ‘risk review‘ whereby they delay the withdrawal of money from your account; some delays may take days, weeks, or months. During this time, your payment will be ‘hanging in the air,’ and you cannot access it.

In addition to withdrawal limits, a freelancer will be charged a conversion rate if they withdraw their balance in a currency other than the one denominated in their account.

On top of that, the local bank in Kenya will also charge you a conversion rate if you withdraw your balance in Kenya Shillings and the bank will also charge you a withdrawal fee depending on the amount.

Since i bank at Equity on many instances except emergency cases, i usually use their transfer services although i have to wait up to 3 business days (weekends and holidays don’t count).

If i opt for M-PESA to PayPal, charges are usually higher than Equity; actually, they are way too high if you add what PayPal will take from you and M-PESA withdrawal fees from your Safaricom line.

Additionally, depending on the amount the funds will be processed to your account in 2 hours to 3 calendar days after transaction confirmation.

If you send someone or receive $20 from you client, here is what Paypal will take from you.

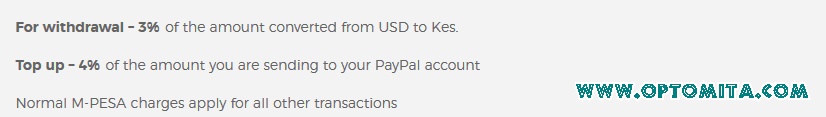

M-PESA Vs Equity Bank charges will vary as follows:

Now you can easily pick your poison, literally of-cos!

Benefits of Using PayPal

Every freelancer desires to be paid for their services in a fast and easy process. Here are some benefits that the Paypal platform outperforms other online services.

1.Quick, easy, and free platform: All you need is an email, identification details, and a debit card from you Kenyan bank. Their website is super easy to navigate, and they have tons of resources in case you get stuck. Linking your debit card is done quickly; all you have to do is follow their instructions.

2.Speed: Transfer between Paypal members is instant, and transfers from Paypal accounts to M-PESA can take 2 hours.

3.Security: Paypal guarantees buyer and seller protection when using their platform. It has a dispute resolution process, can help in refunding and reimbursing your funds. All you have to do is thoroughly read their user agreement to see what is covered.

4.Affordability: Well am not saying they are cheap, but they are not expensive either if you compare with other service providers. Paypal over the years has sort of revised their charges to be as low as possible. Problem is they are yet to get to my preferred low. They also do not use a standard fee structure.

5.Effortless record Keeping: Paypal history dates back to the day you created an account. Users can create and download detailed reports of their transactions period dating back seven years ago. Users can download transactions activities in PDF, CSV, TAB, or Quickbook formats.

6.Acceptance online: A freelancer needs tools and those tools cost money, and if your market does not have any of the means you need, then buying online is the better option. Paypal is now a ubiquitous and popular payment option for many online shops, as well as websites that you may have subscribed to pay certain services.

How to decrease Paypal fees

1.Start by changing how you take your money out of Paypal. Your international clients should not pay you via cheque to start with. That will attract more PayPal charges if you are not a resident of the U.S.

2.Take advantage of Equity bank Paypal service. Transferring more significant amounts via Equity attracts a lower commission actually if your funds pile and withdraw it you will get a discounted percentage. That is pretty sweet, right?.

3.Avoid Paypal to M-PESA agents at all cost. These wheeler-dealers will help you transfer your money to M-PESA “pap,” but the charges associated with that are extravagant and wildly crazy. They might save you time, but the expenses that come along with that are not worth your hard-earned money.

4.Always add Paypal fees into you freelancer rate/quote. Most clients i have worked with allow this, and if they don’t, i always strive to add the cost anyway. Such will help you cover those fees, and you will still earn the amount you had anticipated.

5.Ask you, clients, to include Paypal fees. Without saying, you should have this in writing as part of your contract with the client. Do not fear to request because most clients are usually OK with this. Whenever you send an invoice make sure you include a 4% fee at the bottom of your invoice.

6.How often does your client pay you? Weekly, twice a month or once per month?. The downside of being paid more often is that you will pay more PayPal fees because Paypal will always charge you a fee for every transaction. You can always opt to be paid once a month to avoid this fixed one-time transaction fees.

To the end

The bottom line is, every freelancer deserves to keep as much of their hard-earned cash as possible. International clients prefer to send money to freelancers through the safest, most uncomplicated, and most affordable channel. Paypal happens to provide all that to most businesses so you should register for an account too.